The higher the frequency of compounding, more the accumulation of wealth. Let’s look at the example of Rs 10,000 at 10% interest compounded for different frequencies. CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

HDFC Bank increases MCLR rate

- On a daily, monthly, quarterly, half-yearly, or yearly basis, for example.

- Here, all you need to do is enter the principal amount you want to invest and the time period.

- Where P represents the principal amount, t is the tenure, r is the rate of interest and n is the compounding frequency.

- For example, a 6% mortgage interest rate amounts to a monthly 0.5% interest rate.

- Simple interest is calculated only on the principal amount and the following investment amounts without adding the accrued interests.

- If we summarize the idea in simple terms, compound interest is interest on interest.

You may, for example, want to include regular deposits whilst also withdrawing a percentage for taxation reporting purposes. Or,you may be considering retirement and wondering how long your money might last with regular withdrawals. This means at the end of 3 years, your investment will be ₹71,538. Now that youknow the approximate value of your investment in 3 years, you can check if the returns are enough for yourinternational trip.

What is the Compound Interest Formula?

However, since the interest doesn’t compound, the overall growth of the investment istypically slower compared to compound interest. Thus, the magic of compound interest allows individuals to earn more over time and increase their investments by a hefty margin. Compound Interest is the interest which we earn on the invested principal plus the interest accrued. It reinvests the interest earned so that for the next period we earn interest on the principal amount plus the previous interest earned. Compound interest calculates the total interest earned for the investment compounded for the different tenures and frequency.

Download HDFC Life App

It is a powerful tool for building wealth and achieving long-term financial goals. A compound interest calculator is a useful tool that can assist you in understanding the growth potential of your investments over time. By inputting your initial https://www.quickbooks-payroll.org/how-do-businesses-use-retained-earnings-and-how/ amount, the interest rate, and the time period for compounding, you can get a clear picture of how your money could multiply. This can be especially beneficial when planning long-term financial goals like retirement or education funding.

A compounding calculator is an invaluable tool for anyone interested in making informed financial decisions. It helps you comprehend the remarkable power of compound interest. A daily compound interest calculator https://www.personal-accounting.org/ demonstrates how even small contributions or investments can grow significantly over time when subjected to compound interest. Equity Mutual Funds are mutual funds that invest primarily in stocks.

Longer Investment Period (Higher t)

The principal amount is INR 100, and the interest earned at the end of 1 year is INR 6 (6% of INR 100). Instead of withdrawing the interest amount, it is reinvested, then the principal amount for the second year becomes operating cycle vs cash flow cycle INR 106 (INR 100 + INR 6). The interest earned for the second year is INR 6.36, this is 0.36 more than the previous year. Even though the amounts look very small, it makes a huge difference in the long term.

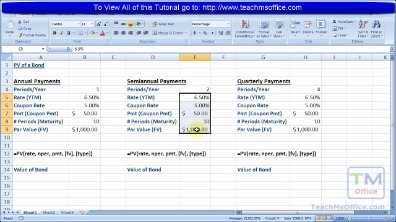

By understanding the importance of compound interest and acting on it by investing in appropriate investments, one can achieve high returns. It’s difficult to calculate compound interest manually since the compound interest formula is a little complex. You can use an online compound interest calculator to calculate compound interest or use an Excel sheet, input the data, and apply the formula to a cell. You can also use the built-in Excel function called the Future Value function to calculate compound interest.

In simple interest, you only earn interest on the principal investment amount. The nature of compound interest makes it extremely lucrative for businesses. When you use a compound interest calculator online, you can avail the following benefits. Historically, rulers regarded simple interest as legal in most cases. However, certain societies did not grant the same legality to compound interest, which they labeled usury.

The power of compounding can bring wonders in your savings or deposits once you figure out how it is calculated. Investing money in India has become a popular way to build wealth over time, and compound interest is one of the most powerful tools available to investors. With compound interest, the interest earned on an investment is added to the principal, and the resulting amount earns interest itself.

On the other hand, compound interest causes the principal to grow because the interest earned on principal earlier is also added while calculating interest. Interest earned on the original principal plus accumulated interest is referred to as compound interest. You’re not only earning interest on your initial deposit, but you’re also earning interest on your interest. Consider compound interest in the same way that the „snowball effect“ occurs. A snowball begins small, but as more snow is added, it grows larger. For example, you choose to invest Rs 1 lakh in a Fixed Deposit (FD) at a compounding interest rate of 10% for a period of 5 years.

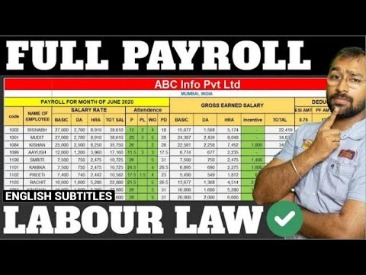

Employee Provident Fund (EPF) is a retirement benefit scheme employers in India offer. A portion of the employee’s salary is deducted towards the EPF, and the employer contributes an equal amount. The interest rate on EPF is currently 8.5%, and the interest earned is compounded annually.

When your investment earns interest, the magic of compound interest helps it to grow faster. It will calculate the newly made interest by calculating the initial capital invested and the gained interest when it earns interest again. Thus, interest will be added to the total investment amount as the size of the investment grows. This loop will continue to allow the investment to increase significantly without the need for additional capital. This cycle has the potential to expand the original investment considerably over time.

With time, compound interest only further enhances the earnings, and the investment grows manifold. If we summarize the idea in simple terms, compound interest is interest on interest. Compound interest is when the principal includes the accumulated interest from previous periods, and the following interest is calculated on this. The number of times interest is calculated in a year is known as compounding frequency.